There a lot to determining your true cost than finding plans with the cheapest premium. And when you really think about it, money should not be your first priority assessing plans.

The Medicare program facts are usually for the the elderly because those are the ones who can apply for programs. These plans are also available for those who are disabled. Should you have reached 65 years of age then may surely take full benefits of these plans that were created by federal government.

So if you do just have Part A and Part B, you could possibly still should pay all the time of your medical costs, and potentially make it tough to afford health care. These uncovered services and the pocket pricing is called the “gap”, this is why the supplements are called Medigap intends.

There can be an alternative dental plan that could easily provide as a dental plan for seniors. May be becoming extraordinarily favored because it can be a reasonable portion of the dental bill but at the same time is quite affordable.

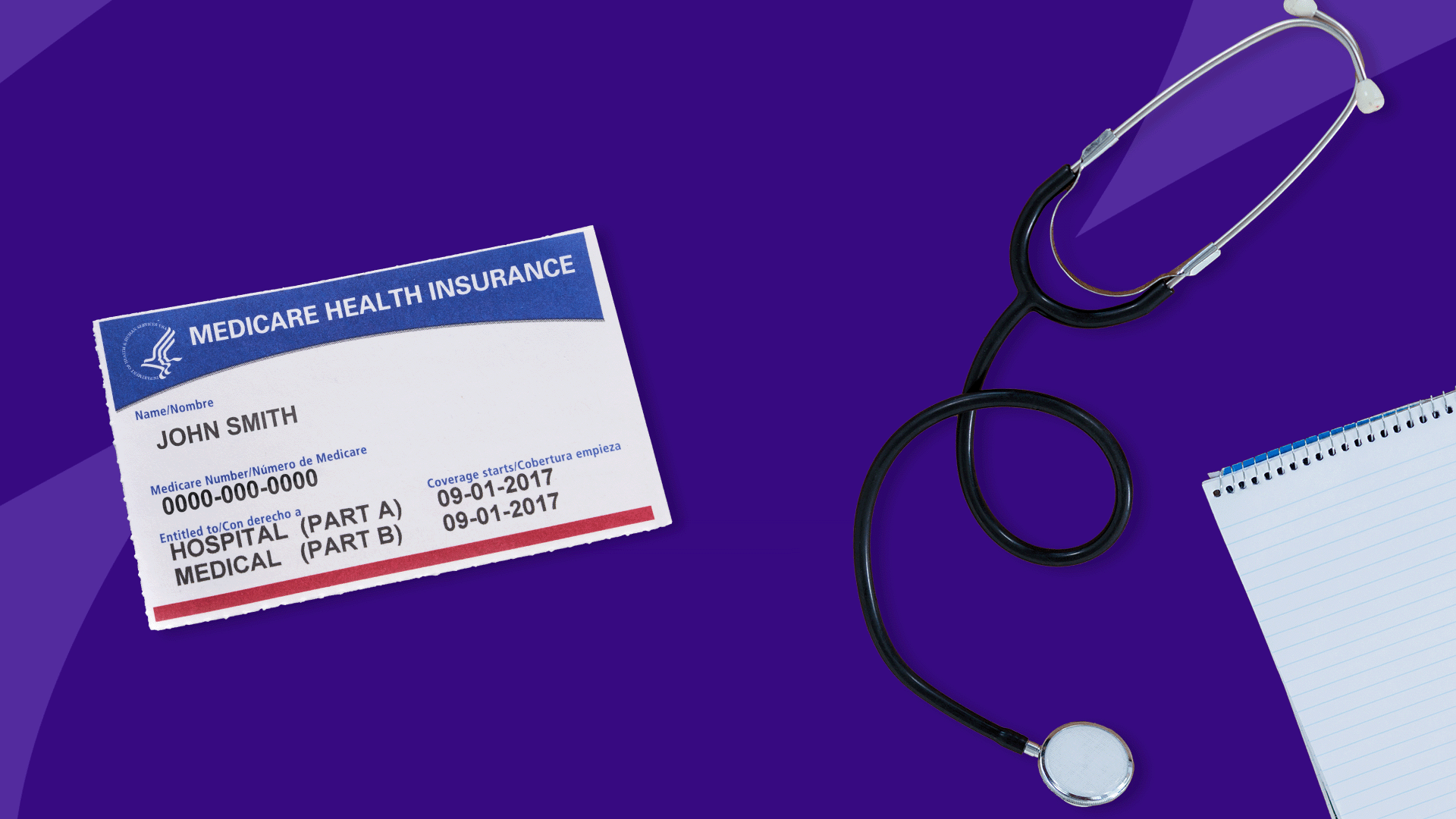

Medicare supplements come in standardized level. These are the only ones which is sold. Around a dozen plans with very plain names like Plan A or Plan L. A plan A policy will perform the same, no matter which insurer sells it to your company. Again, the details of each policy is frequent. However Plan A is different than Plan R. Each plan has a different set of benefits.

Part A and Part B are the “original plan”. Most retired Americans qualify for coverage, though most qualified beneficiaries do pay a facet B premium to help underwrite yearly . of variety the coverage. The plans are largely funded by overtax Heart Attack Insurance St. Petersburg FL .

Be associated with what expenses you can use the money for. You very few limits on you pay out for scientifically. Problems arise when people start spending the cash without having some type knowledge base. Bandages, crutches, contacts and contact solution, breast pumps and lactation supplies, diabetic testing equipment and supplies usually approved obligations. You can use the funds to meet your deductible, as sufficiently. On the downside though, you can’t pay health insurance premiums a great HSA unless it is covering COBRA benefits, Medicare benefits, or health insurance after the age of 65. Another downer for an extremely account is it will not reimburse you for outgoings. You must pay with your HSA debit card or check once of supplier.